Funnily enough, accounts aren’t prepared by tossing numbers around – like darts in a game of darts! You see, for a business to make good decisions it needs accurate data.

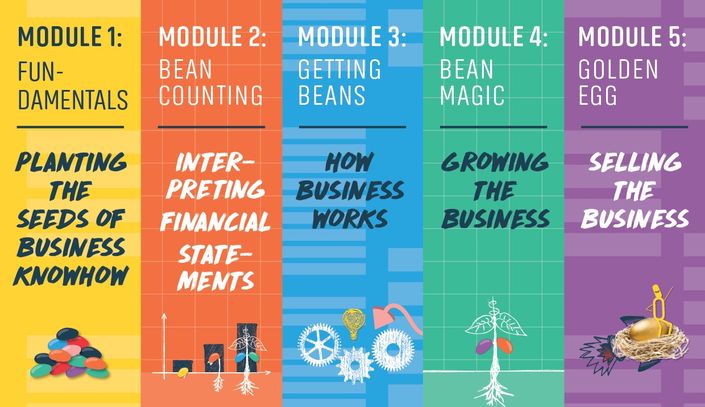

In Module 1, we cover the basics of accounting (a.k.a. keeping the books) – where it’s come from (and why). Then we go on to balancing the books, double entry, why the banks seem to lie to us, and why it’s right for debits to be on the left. We work through loads of examples (= crunch lots of numbers) to ensure your understanding becomes second nature – so you can do them in your sleep – beats counting sheep!

Isn’t it funny how professionals tend to hide behind their profession!? Accountants are as guilty as any. We tend to speak as if you know what the financial statements mean, while knowing you probably don’t. What use is that!

So, let’s get you to the point where you can be the one asking your accountant tricky questions! Where you know how the numbers came together, and what the numbers mean – so when the Beans Talk, you listen (and understand).

Module 2 discusses the make-up of the financial statements themselves – the different types of profit mentioned in the Profit & Loss (Statement of Financial Performance), how overheads can get under your feet, what depreciation is, why cash doesn’t necessarily equal profit, and what a good Balance Sheet (Statement of Financial Position) should look like.

Then we move on to the time-proven ratios used by banks and others to judge how the business is performing and how secure its position is. These are part of the key performance ratios (KPIs) section of the course.

As you can see, there are plenty of options here for better understanding enabling you to make better decisions, and better decisions mean more profit … A good return on your investment (ROI) in the course, then!

Interesting, isn’t it, how we consider all businesses to be different? Different industry, different product, different sector, different size, … Yet they all aim to make a profit.

Are they really different, then? Actually, no! Business fundamentals are just that – fundamental to business, of any kind.

In Module 3, we look at those fundamentals. We discuss business structure – what roles there are within a business, when a sale is actually a sale, why price shouldn’t be your profit determinator, what item listed as an asset in your Balance Sheet is actually a cost, where to find the money hidden in your Balance Sheet, budgeting / forecasting, business planning, and more.

You know how common sense isn’t that common? Well, in a similar way, the magic we discuss in this course is not really magic – because the magic wand is called “work”. But is it work focused on the right areas, done the right way. And the successful results attained make it seem like, well, magic!

Module 4 is designed to take your business to the next level, and beyond. We look at the leverage points of the business, follow the full profit trail, and look at what can be done at each leverage point to increase the flow of cash (as distinct from profit) through the business. Once you Know the leverage points it is much easier to plan (yes, plan) the How of increasing the flow.

Along the way we look at data that should be collected, but often isn’t. We look at improving customer retention, different projects you can implement, and a whole lot more. Once again there are lots of reading recommendations.

Let’s be honest, the main reasons we get into business are to have more time, control and money. But, shouldn’t a business be an asset? An asset you can sell for a (very!) good price? Surely, we don’t get into business just to close the door one day, and walk away…

In other words, growing the value of the asset we call our business is another reason we start it in the first place – no one starts a business without the ultimate aim of selling it. Selling it for a good price and (assuming we wait until then) having a comfortable retirement – having time, control and money to the full.

In Module 5, we look at growing the size of the Golden Egg – what you need to do, when you need to start, and the best buyers to find. In particular, we cover the importance of documentation and systemization.

We also look at establishing a retirement plan – so you know what minimum selling price you need, and we cover managing your exit.

Just think of the peace of mind having this Know-How, and implementing it, will bring – let alone the additional cash!

Who Is The Target Audience?

We want everybody to do it! Seriously! The course is designed for:

- Students (high school and above, if not earlier)

- People in the workforce, and

- People wanting to get (back) into the workforce.

Why The Full Bundle?

The majority of people end up working (for money) within an organisation for which numbers / performance are important. For most people, this employer is a business, and a significant number of people end up owning one themselves! Yet, in spite of this, schools do not teach anything about business. So, most people end up not knowing what a business should look like, how it should work, or what functions are necessary within a business, let alone how to grow the business, or how to exit the business successfully.

This course, is a start in changing this. It’s a start in making people more able to manage their business, more able to strengthen it to deliver better results, and more able to exit the business well financially.

How Does It Work

How Long Will This Take?

It depends how hard out you want to go. But we envisage you should be able to get through each Module in around ten hours total.

How is the Course Structured?

The Modules includes a number of KnowHow papers, with accompanying Quizzes. You then move on to Examples, followed by parallel Exercises. Finally, for Modules 1 and 2, there is a multi-part Test, just to make sure you’ve grasped it all! First, we cover double entry, debits and credits, the accounting equation, the chart of accounts, accruals, prepayments, provisions, and much, much more. Then we move on to accounting jargon, trial balance, depreciation schedule, balance sheet, income statement, cash flow statement, key performance indicators, budgets and more. Next, we go through the essential components of a business, what business structure is, and the six areas a business plan must cover – Marketing, Operations, Human Resources, Technology, Financing and Innovation. Then we move on to the four ways to grow a business, the various strategies necessary to grow a business, business levers and what to do with them. Finally, we discuss the need to grow your team, doing the business housework, preparing for what comes next, staging the exit, and more.

What Do I Get?

You get a login to enable you to access:

- The PDFs of:

- The KnowHow papers

- The Examples

- The Exercises

- The Exercise Answers

- The Tests

- The Test Answers

- The Quizzes (and their answers), which are hosted online.

Testimonials

Crystal Paine - Money Saving Mom

"I never really understood the why behind many of my tasks. While working through this program in preparation for my daughter, I was able to gain a better understanding of the why behind how I do things, such as; balance sheets, fixed assets and depreciation. With this new understanding, I am able to do my job much more efficiently. This in turn makes me a more valuable asset to my company."

Your Instructor

I have worked in a variety of industries – from retail to printing, an international airline to a government health enterprise – and in organisations of various sizes – from global engineering giant to boutique accounting firm.

My roles have encompassed financial and management accounting, company and tax accounting, finance and operations management. My focus has always been on improvement – processes, my role, results – whatever I could do to contribute to bettering the organisation.

I’ve worked closely with Medical Professionals from various specialities, Engineers, Logistics professionals, Printers, Manufacturing specialists, Retail gurus, and clients from all over the spectrum – and, yes, I’ve tried to make things better for all of them.

Courses Included with Purchase